HSBC races to hedge against falling rates

By Nicholas DunbarMarch 18, 2024

UK banks are keen users of ‘structural hedging’ to smooth out the net interest income they receive on demand deposits.

The idea is straightforward: accounts that pay zero or low interest behave like fixed-rate liabilities because balances tend to persist over time. Meanwhile, banks can earn a floating-rate ...

Already a subscriber? Log In

Read Next:

March 7, 2024

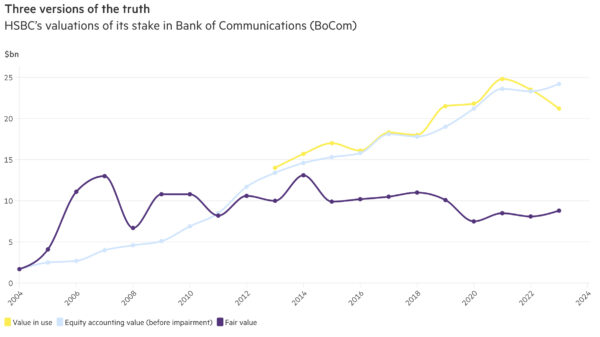

Is HSBC’s stake in Bank of Communications overvalued by as much as $12bn?

Accountants urge HSBC to write down value of investment in Chinese bank

Read more