EU banks withstand severe stress tests

By Justin PugsleyAugust 11, 2021

As in the previous exercise, the main drain on capital would be credit losses and longer term, significant decreases in profitability, particularly net income, would also contribute to capital depletion.

The authority modelled a scenario where EU GDP would fall by 3.6% and unemployment would hit 12.1%. The EBA excluded ...

Already a subscriber? Log In

Read Next:

May 16, 2024

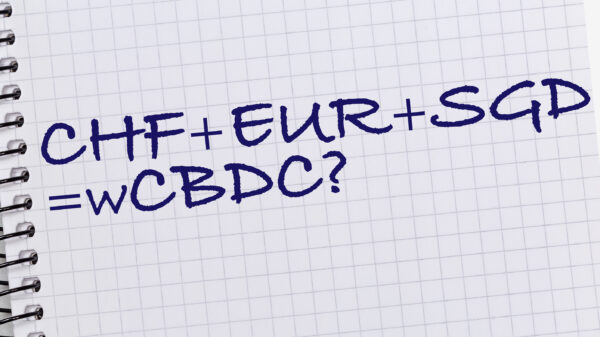

Wholesale CBDC cross-border trading test ‘deemed a success’

BIS experiment was a technical achievement but liquidity demands may be prohibitive

Read more